C-PACE 101

What is C-PACE?

A proven way for commercial property owners and developers to finance new construction, renovations, or recapitalize completed projects with long-term, low-cost capital.

Get Started

Key Features

C-PACE can finance up to 100% of eligible hard and soft costs

Can be used for new construction, complex renovations, or simple building upgrades

Can refinance expensive capital with more efficient terms

Reduces equity needed, increases sponsor returns

Can cover 100% of eligible hard & soft costs

Non-recourse after construction

Low-cost, fixed or variable rate

Variable rate not available in some states.

Up to 30 year amortization

Increases cash flow & preserves equity

Eligible Measures

Energy systems (e.g., HVAC, lighting/electrical, elevator modernization, solar)

Building envelope upgrades (e.g., roof, windows, doors, insulation)

Water conservation and plumbing

Resiliency (e.g., seismic, wildfire, hurricane/flood protection)

Sample Projects

New construction of a hotel

Elevator modernization for an existing office building

Solar array installed on an existing building

Adaptive reuse of a historic building into a mixed-use apartment community

HVAC and roof upgrade at a warehouse facility

FAQs

What is C-PACE?

C-PACE (Commercial Property Assessed Clean Energy) is a low-cost, non-recourse financing option for projects that improve a building’s energy performance or resilience against natural disasters. C-PACE is an alternative to more expensive options like mezzanine loans, debt funds and outside equity. C-PACE loans are repaid through a special tax assessment on the property, with terms up to 30 years. C-PACE is available for commercial, multifamily, and industrial buildings only.

What kinds of projects can C-PACE finance?

C-PACE can finance new construction, gut rehabilitations, renovations, and simple upgrades – and it can be used to recapitalize or refinance completed projects. Eligible measures include energy systems (HVAC, lighting/, electrical, elevator modernization, solar), building envelope upgrades (roof, windows, doors, insulation), water conservation, plumbing, and resilience measures like seismic, wildfire, or hurricane hardening.

Can C-PACE be used to refinance?

Yes — C-PACE can refinance higher-cost debt or capital that was used for eligible improvements, providing better long-term terms and freeing up equity for other priorities.

How much of my project can C-PACE cover?

Up to 100% of eligible hard and soft costs — including design, engineering, permits, and other related expenses.

How long are repayment terms?

Repayment terms can extend up to 30 years, with low-cost fixed or variable rates (variable rates are not available in some states).

Is C-PACE non-recourse?

Yes — once construction is complete, C-PACE financing is non-recourse, which means the obligation stays with the property, not the owner personally.

How does C-PACE fit in the capital stack?

C-PACE is typically used alongside other financing. It can reduce the equity needed for a project or replace higher-cost debt, helping sponsors increase returns and ease the equity raise process.

What is a typical project example?

Sample projects include new hotel construction, elevator modernization for an existing office, solar array installation, adaptive reuse of a historic building, or an HVAC and roof upgrade for a warehouse.

What is FASTPACE’s role?

FASTPACE is a full-service, tech-enabled C-PACE lending platform with a network of over 40+ lenders. We help borrowers secure flexible capital for all types of projects — including specialty assets and retroactive financings — while keeping transaction costs low and the process efficient.

C-PACE in the Capital Stack

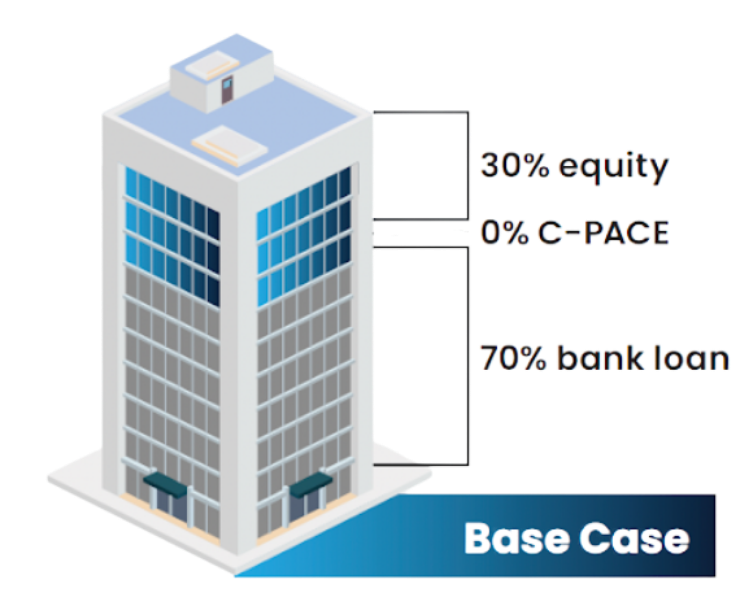

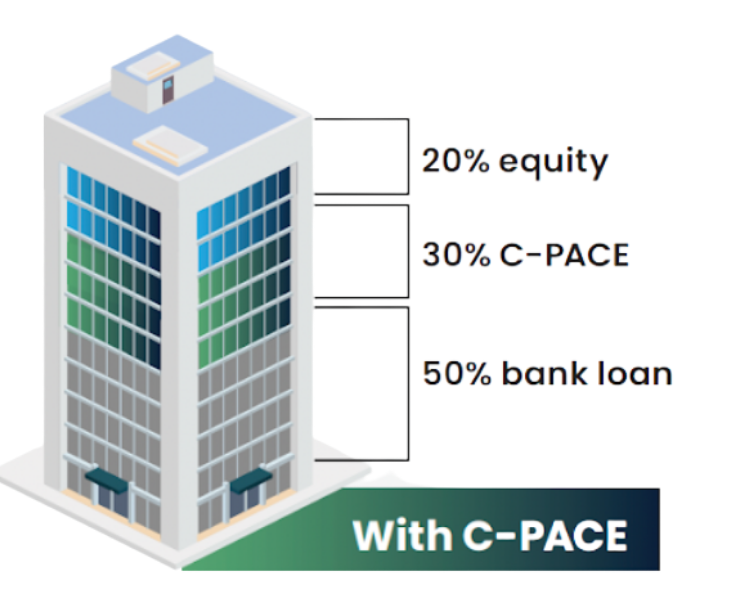

Hypothetical Capital Stack 1: Increase Overall Project Leverage

C-PACE can reduce the equity needed for a project, which allows for a greater overall return to sponsorship and eases the equity raise process.

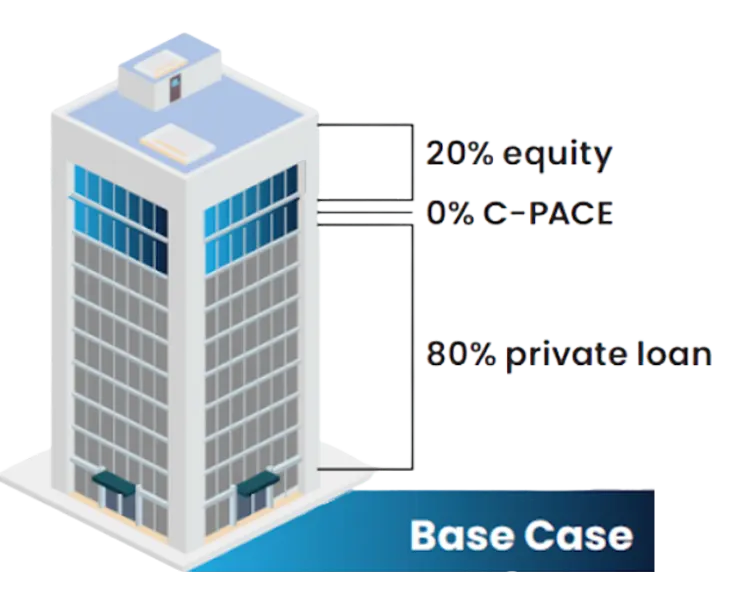

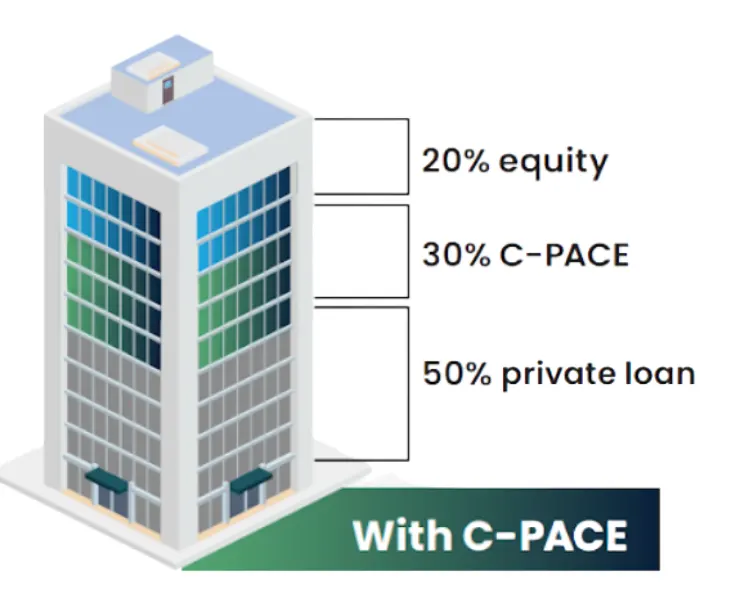

Hypothetical Capital Stack 2: Reducing High Cost Debt

Equity remains constant but C-PACE financing is deployed as a significantly cheaper leverage alternative to high-cost debt financing (e.g., private lender or debt fund).

Proven Across the Country

Owners and developers have used C-PACE to finance over $10 billion in commercial, multifamily, and industrial projects as of mid-2025.

Want to join their ranks and see what’s possible for your project?

Quick Quote